-

On equity, access, and inclusion as the world digitizes

In response to

James,

You have identified an enormous problem in our society, which is the broken nature of our identity system and the federal policy and infrastructure that surrounds it. Politically, it is just not possible to create a better solution right now - look no further than the political challenges moving to Real ID. These shortcomings have forced everyone to find alternatives, which unfortunately frequently do rely upon the credit system in America. And that’s not just private industry, but the government itself points to credit-system-based identity challenge questions as a best practice. This is the real issue that deserves your passion and what I have personally committed my own energies to improving.

All of that said, RON and Notarize do have solutions to these issues. First and foremost, RON is an option and not a mandate. Anyone can still transact in paper, no company can force anyone into a digital experience. Second, the laws still allow for a known prior relationship with the notary. Third, they account for the concept of a Credible Witness which is someone who completes identity verification and attests to the person’s identity, etc. For all of these reasons, I believe that RON has better addressed these issues than almost any other digital service as we not only have practical solutions, but a legal framework that allows industries to transact even when issues arise. I’ll note, the issues are not just impacting minority communities, but people with a damaged drivers license, older webcams that can’t capture a good image of an ID, victims of domestic abuse who don’t have their paperwork, etc. Some people simply cannot pass a digital identity verification process for a long list of reasons. This is a problem much greater than online notary and the National Institute of Science and Technology is constantly updating their guidelines, recently publishing a new IAL2 standard for Remote Proofing that addresses these very issues. We are the first and only platform to be audited and certified IAL2 compliant.

We have made an enormous investment in these issues. We are fully compliant with web accessibility standards for the hearing, vision, or physically impaired. We have passed legislation to allow for language translation for ESL communities. We also provide notaries who speak other languages and will soon translate our apps too.

And our product isn’t our only tool, so is our advocacy. We’ve worked to overturn racial covenants in property deeds. And when it doesn’t even make sense for something to be notarized, we advocate accordingly. For example, we’ve successfully removed requirements that battered women notarize a form to file a restraining order.

We’ve conducted studies with the Urban Institute making clear there are real issues of access to notaries by socioeconomic status, race, and geography. To be explicit, poor people in minority communities have worse access to notaries. Rural communities too. Our armed service members and their families have extreme difficulty. The Spanish speaking community is often defrauded by Notarios Publicos pretending to be attorneys (common in Latin America). A notary unlocks countless government services, financial programs, etc. It is not acceptable that some people need to spend an entire day to complete a critical transaction. And most notaries are only available during business hours, making them inaccessible to anyone whose job is inflexible and extremely costly to anyone paid hourly. RON levels the playing field so anyone, irrespective of language, location, or ability, can instantly gain access to the services they need to complete a transaction in minutes instead of hours. And our platform and the regulations we’ve helped to pass ensure that people who lack what is required to identify themselves still have the ability to connect.

I do have other concerns (and this is something I’ve said for years) - industry cannot create price or other incentives that disadvantage people who cannot transact digitally. For example, it is well established now that a digital mortgage closing saves real cost for the lender and title company. Everyone feels that the cost saving should be passed to the consumer, which is a just intent, but that very well could constitute an unfair practice. Those cost savings need to accrue to the whole operation and provide cost savings globally, irrespective of closing method, for example. I’ve advocated for policy around this for many years.

Regarding fraud, we have made an enormous investment here and will be sharing a great deal on this soon, but we are successfully capturing things like deep fakes, synthetic identities, etc. We also provide a complete chain of custody, ensuring documents are not altered or stolen, copies are not retained, etc. And we provide a total evidentiary trail of the transaction, for which we’ve received acknowledgement from groups like the Attorney General Alliance for assisting with things like election fraud.

I do appreciate your concerns, but would simply ask that you join the fight for change and progress. We absolutely can create solutions for online identity verification that do not disadvantage any groups of people - and notaries are critical to ensuring everyone can transact securely online. We can also accelerate business, reduce errors, fight fraud, and ultimately save enormous sums of money and TIME for consumers.

We do not have all of the solutions (yet), but I hope this makes clear how seriously I take the issues and I will always be open to any product or policy change that ensures everyone can complete their most important transactions safely and on their own time.

Tweet Vote on HN -

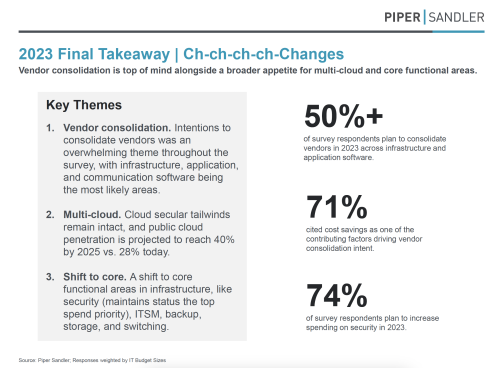

The enterprise version of the great re-bundling & vendor consolidation trends

One of the strongest trends I’ve seen over the past few years is the desire amongst enterprise buyers to have fewer vendors and to consolidate services.

I’ve seen this for several years in my own experiences selling software. It is yet another reason why we made the leap from a point solution (Notarize) to a platform (Proof) and we will continue to add more services to Proof to take advantage of this trend. I feel strongly that we’re now on the other side and we’re now seen as a consolidator, evidenced by customers asking us to provide adjacent services to our core offerings.

This ties into the discourse around the great unbundling and re-bundling that’s occurring, but I think most of that commentary focuses on how bundled super apps provide user experience benefits and economies of scale for consumers. There’s a larger trend in the enterprise focused on cost savings and risk mitigation.

This trend isn’t just buried in Proof’s and my own selling experience, broader market data reveals this plain as day.

These were taken from the 2023 CIO survey conducted by Piper Sandler, essentially predictions to start 2023.

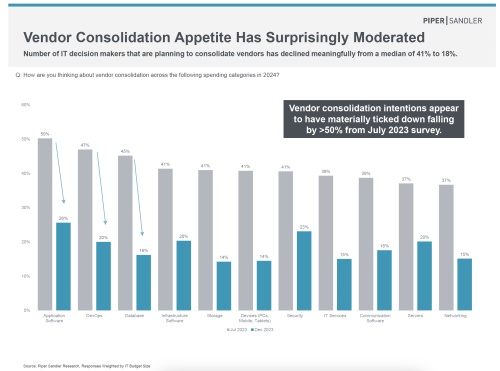

As we enter 2024, the same report suggests these trends are dissipating.

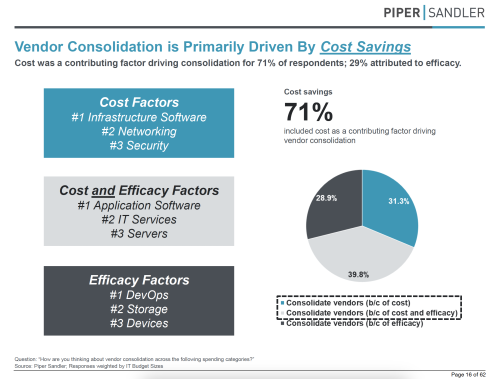

FWIW, I don’t agree with this at all. The 2023 report suggested that the primary motivation was Cost Savings. The 2024 report makes clear elsewhere that buyers plan to spend more money this year - perhaps the pressure to reduce costs is off or not top of mind.

BUT, risk and InfoSec are still HUGE drivers for vendor consolidation. We are seeing this everywhere. Sophisticated customers want less risk and using fewer vendors is a way to achieve this. Not only for its direct sake, but because each vendor relies on their own set of vendors so it is a geometric problem for the enterprise buyer. And let’s face it, startups don’t always pick the best vendors. We’re seeing this articulated by customers as “4th party risk,” which they very much want to control.

This is pushing us to consolidate our own vendor stack and to insource more of our own technology. This can be at odds with enterprise requirements for redundancy and disaster recovery - or it means when you insource, you really need to do it right so it is highly scalable and redundant. You can’t just hot swap from external vendor 1 to vendor 2.

So much for being in an era of micro-services and cheaper development costs. The reality is that if you want to play to win, you eventually have to just do the goddamn work.

At Proof, we are becoming the trust layer for critical commerce and we cannot win without the largest players on our platform. Being enterprise grade means much more than people appreciate - and costs much more too. I believe this trend will accelerate and the companies who solve for these issues will become the pillar platforms with the right to consolidate what’s around them.

PS - Shout out to Rob Owens at Piper Sandler. Big fan of their work.

Tweet Vote on HN -

Companies with the capacity to innovate are worth 10x & the team you build is more important than the product

I believe deeply that the team and culture you build are more important than the product. Most companies only ever have one idea and even if that idea is wildly successful, they fail to build a culture of innovation. And the music eventually stops. Companies must avoid the trap of rock polishing and evolve to become civil engineers, building toward a vision and laying a foundation for years of innovation and the ability to respond to market changes. Companies with this capacity to innovate are valued 10x. Companies with a customer base plus this ability to innovate become the pillar companies of tomorrow when they can leverage their customer base as a highly efficient channel for their new products.

Think about Microsoft and their ability to keep selling new products to the same customers over and over again.

I have been obsessed with this idea for years and Proof (formerly Notarize) represents that journey. And because of the foundation we’ve laid, we are accelerating. My biggest learning? It’s not about me, it’s entirely about the team - they have to take over - team Proof will innovate for years with or without me.

I share this now because I believe what we’re seeing in this market correction is exactly this dynamic playing out. Companies without a demonstrated ability to innovate and expand their markets are getting crushed. 2023 was the year of put up or shut up - companies either owned a strategic wedge they can expand from with a clear vision to innovate and increase their TAM or they didn’t.

And, I think an under-appreciated cause is that many larger and more established companies are suffering from having hired too many professional managers and generalists. Versus a common characteristic of winning companies — their team stays engaged and their early employees rise to leadership roles over time with the full benefit of context and alignment.

I’ll point to HubSpot, the core of their product team is still there, still innovating, still building on a foundation laid years ago as they’ve gone from 1 to many products.

—

I posted this on LinkedIn in June of ‘23. I believe it even more strongly now.

It’s been 7 months since and I’ve come to appreciate it requires real risk taking. Teams must be willing to disrupt their core products AND also themselves, how they work, and what they focus on. Individuals must be comfortable branching out of their areas of expertise to learn new fields. Discomfort is ubiquitous on innovative teams and it must be celebrated. Wow that’s a powerful team when it happens and I’m loving working with the Proof team right now.

I can say this with confidence not only because of my own experience at Proof. So many founders have reached out to me to discuss our transition from Notarize to Proof. So many actually have the big idea that transitions their business from a point solution to a platform, but they just won’t take the risk, or their team won’t, or their board won’t let them.

Also, looking beyond Proof, I’m seeing companies successfully make acquisitions to solve this problem. In truth, a company can fail to innovate and still succeed so long as they can see their position clearly and act strategically. I am not saying Okta can’t innovate [I don’t know them well enough], but their acquisition of Auth0 is a perfect example of a company leveraging M&A to ensure a pipeline of products they can sell into their base. Again, no comment on Okta, but a company completely reliant on M&A to maintain a product pipeline is not a company I know anything about. Many exist. Look elsewhere for thoughts. We’ll keep building.

Tweet Vote on HN -

InVision shutdown - what I learned from their short reign and ultimate demise

It’s a sad day to see InVision shut down.

Most startups die for the obvious reasons, but I think there’s something to be learned from InVision’s demise.

Positive - InVision showed me the power of the Invite-to-collaborate & charge to organize growth loop, which inspired a lot of my thinking at Notarize. When InVision was on the rise, I think it was entirely a result of this growth loop paired with their pricing model. It was bottoms up. A designer would register for free and share a file with colleagues and collaborators to capture comments. Those people could also register for free. It got everyone hooked, trading files, collaborating, becoming a part of the company’s nervous system. But they didn’t give those invitees any dashboards or ability to organize what was shared with them. And there was no team view. As soon as a team got hooked on InVision it became organizational chaos. Your only option was to pay for the enterprise edition. And since in most tech companies it is the exec team commenting on designs… companies paid.

Brilliant.

This greatly influenced Notarize’s collaborative features around real estate closings. A lender can send hundreds or thousands of files to individual title agents, but as soon as those agents wanted an organized view or an agency wanted a team view… they had to pay. [Note, we’ve since changed this practice but that’s a post for another day]

Two things on InVision’s failure.

Figma leapt InVision by leveraging innovations in browser technology. For all of us, we always need to be asking how new developments in platforms might totally disrupt our category or enable a 10x experience.

More importantly, InVision failed to innovate beyond their core product. I wrote this on LinkedIn last year and believe InVision makes my point.

Tweet Vote on HN -

A VCs most critical task

I have decided that an early stage (Series A-B) venture capitalist’s single most critical task is to make certain their portfolio companies do not hire the wrong executives.

There is nothing more detrimental to a growing company’s progress than hiring the wrong executives just as the business is starting to scale - exactly when the CEO and Founders are letting others own key areas, teams are hired, people are trained, and culture is set. The wrong executives blow resources, repel critical talent, and in many cases kill companies.

It is not just about the executive’s skills, culture, and ambition, but their stage-fit for the company. Process too early is deadly if it comes at the expense of creativity, scrappiness, and momentum.

Startups need fire starters, not suppressants.

A VC can rise above if he or she can actually help the company identify and recruit the BEST executives, but that’s icing on the cake beyond the foundational need to block the wrong executives from entering the company.

* I didn’t include Seed investors because these companies aren’t yet scaling and hiring executives, they’re building product and validating markets.

** I am debating with myself if this means that industry-focused funds with more specific talent networks are better. Perhaps true in B2B.

Tweet Vote on HN -

Notarize: Operation Chillax

Notarize recently shut the entire company down, giving everyone one week off. I thought I’d write a blog post about it but realized that the email I sent internally gets the job done. For those interested in why Notarize launched #OperationChillax, here’s more.

From: Pat

To: Everyone

Date: July 7, 2021

Subject: What would you do with a free week? Announcing Operation Chillax.Hello everybody!

Notarize will be closed the week of August 9th to 13th!

[and leaving the lights on for customers]

Wait! What? For real?

As you all know, I took a vacation. It was great to pause and reflect on all that we’ve accomplished. Above all else, I felt an enormous sense of gratitude for everyone’s commitment to our mission and to each other this past year. And in realizing how much we’ve accomplished, it’s hard to ignore how hard people have worked and how much people have sacrificed to serve our customers and advance our cause despite so many challenges at home.

As I shared during last week’s Fireside Chat, I’ve been thinking a lot about mental health and burnout. And I’m concerned. It’s a classic cliche that startups are a marathon and not a sprint, but what no one admits is that it’s actually both. It’s a dead sprint that lasts way longer than anyone can survive. And this year it was all of that plus the world falling apart around us.

It’s time to take a break.

I’ve engaged many of you to understand how you feel and what you’re thinking. A few things have resonated:

- People are experiencing burnout

- People are coping with the (hopeful) end of COVID differently. Some people are finally grieving lost loved ones, others are finally dealing with medical procedures or other issues they put off, and some are simply making up for lost time with friends and family.

- People struggle to take real time off at Notarize (and at any company). Although you may be off, the company is not and it’s a challenge to avoid and ignore the constant barrage of inbound calls, emails, and demands of your time.

In one of these conversations just last week, someone shared that Adobe shuts the company down. In addition to everyone’s vacation time, the entire company closes and people get real time off. Everyone out. No one bothers you. All customers are told.

Well, that conversation was just last week. I thought that sounded like an awesome idea. The leadership team agreed. And since then, Diana and the HR team have spearheaded an effort across the company to make it happen. [Thanks, team!!]

So why these dates? Well, we just had the idea and we’re running out of time. The end of August will be crazy with real estate volume and September is back to school so people with kids can’t take real time off. And, we want to give some notice so any dates in July feel too soon.

Now, the challenges.

We still have a service to run and to be certain that we keep the lights on for those who need us, some of our front-line roles will actually take one of two upcoming weeks off. While their dates may differ, I am confident that they’ll get real time off during their break. Wendy, Denise, the ops leadership teams, and any other teams serving essential services will be sending more info later.

We need to tell our customers and partners. We’re still working on this plan, aiming to get communications out early next week. More to come on this as well.

That’s it. There is no catch. Do something epic. Take the longest nap in history. Go see your Grandma. Plant those flowers. Teach your kid to ride that bike [what I’ll be doing!]. Binge that show. Hike that mountain. Do you!

Pat

Tweet Vote on HN -

Crossing the chasm thrice - unique challenges faced by Notarize and B2B startups in regulated industries

Crossing the Chasm is a well-known concept. Startups start by acquiring innovators, spread into early adopters, and then stall as they try to acquire the early majority of customers who care less about the novelty of their solution and instead need something that solves real problems and is packaged and sold in a manner they can buy. Jumping to the other side requires rethinking everything.

Many startups shoot out of the gates by selling to other startups only to hit a ceiling when they realize everything about how they package and sell their product must change - normal companies don’t buy software like startups do. And there are only so many startup customers in the world.

I’m used to this pattern. Anyone with a day in venture capital can spot it.

Enter Notarize.

It turns out, if you want to bring a disruptive solution into a regulated market, you likely cannot sell to the innovators and the early adopters. They do not have the market power to try a new solution nor are they able to secure the required approvals. They want to and they’ll waste a lot of your time trying to, but the laws of physics likely keep anyone but the big players from going first.

Notarize’s first customer in real estate was the fourth-largest lender in the country, United Wholesale Mortgage. Our second was the largest homebuilder, Lennar. Our third was the largest real estate company, Realogy. These companies had the balance sheet to try a new process, often literally self-funding mortgages to prove the model. And they had the market power to pull their ecosystems in, pushing many of the largest banks, title companies, and the GSEs to allow them to close loans online with us.

And so, Notarize couldn’t build small. We had to build for the enterprise out of the gate. Soc 2. Onsite security visits. Disaster recovery plans. SLAs. Long, expensive enterprise negotiations with equally long, custom contracts.

This is no different than any enterprise B2B startup, but our customers knew they were taking a risk by going first. To win these deals, we massively undercut our pricing in exchange for their validation of our concept and legal standing.

But Notarize doesn’t just aim to serve enterprise B2B. We’ve always invested in our retail and small business platform with the idea that once the enterprise buys and validates our solution, SMBs will have the confidence to purchase on a credit card. “Oh, you work with the largest lenders in the country, good enough for me!”

But guess what? Just like the startup that sold to other friendly startups and then fell on its face trying to win an enterprise deal, we were equally snowblind climbing down the mountain to serve SMBs. When every deal has been hard fought and negotiated for months, how do you change your DNA so people can simply click to buy? And when deals have been discounted to win the logo, how do you reset the market to establish and then enforce our pricing and sell on value?

Our history can be summarized as:

- Build a full scale rocket with redundant fuel supplies to shoot over the chasm and land on a distant, enterprise continent.

- Follow the breadcrumbs back across the chasm to SMB land, bringing proof from the distant land so people will believe and buy.

- Establish real pricing by market testing with SMBs

- Cross back into the enterprise to sell the full value of our offering

What’s the advice as you try to cross over the chasm in reverse, coming down market?

Ship code and force your customers into your product.

When you’re winning your first enterprise deals, you’ll layer in an endless amount of human involvement to meet their needs. And you’ll run into a laundry list of “blockers” that prevent your customers from scaling. These two dynamics create terrible habits. You end up with an endless set of excuses and justifications as to why customers aren’t scaling. And, because shipping into the enterprise is hard, you’ll have a million reasons why you can’t “just ship it.”

Do it. Only by forcing people into your product can you see if they’ll actually use it or not. And guess what, you’ll find that SMBs are much more willing to excuse a few shortcomings than the enterprise. And you’ll iterate and iterate until you get it right.

I hate most startup advice because it’s always one company’s hyper specific learnings painted as a broadly applicable strategy. I have no idea how many other companies will meet this mold, but I do know that all of the typical reading and materials about finding product market fit have had zero relevance at Notarize.

If you aim to follow in our footsteps, know that these challenges just take time to solve. And time requires money. Set your fundraising strategy accordingly.

Tweet Vote on HN -

When Customer Experience Eats the Software and Real Estate World

Reinventing the home buying experience is quite possibly the greatest untapped opportunity in the American economy.

We can all agree that it shouldn’t take 46 days to get a mortgage. Houses sit on the market for too long, buying agents are compensated more if you spend more, and fees and commissions are too high – the list goes on.

Alex Rampell of Andreessen Horowitz recently wrote a post about this very topic that’s getting much attention. He states that to shorten this process, “you will buy your house from, or sell your house to, a company.” And he’s put his money where his mouth is by backing Point, Flyhomes, Opendoor, Divvy, and others.

These companies all offer a different solution to the same problems: we need a faster, easier, cheaper real estate transaction and more liquidity in the market.

But is the only solution for companies to start buying and selling homes? Or can the industry at large actually achieve the instant mortgage that creates real liquidity for everyone?

Alex’s post really only scratches the surface.

Some Added Context

The real estate market is an interconnected ecosystem. At the end of the day, every transaction is filed with a county recorder, insured, often funded by someone other than the lender, and the mortgage is typically sold into the secondary market and securitized. Virtually every company is built on top of this infrastructure and is required to comply with it.

Take Quicken Loans’ Rocket Mortgage. Everyone assumes its a digital mortgage, but it’s really only a digital mortgage application. They’re still printing 280 pages and driving to your house for the closing, then mailing the documents across the country numerous times. Their entire operation grinds to a halt as a result.

The same is true for the new class of home-buying companies that Alex Rampell describes. They use technology to make a faster buying decision and provide incredible customer experience, but they still close in paper at a snail’s pace. This keeps them from having truly disruptive cost or time efficiencies.

Alex talks at length about the end-to-end digital mortgage experience, but you can’t get there without going through the closing. The closing is the main event; everything else is just setup.

Given how much you can do with a phone these days, people often assume you can close digitally, but it’s been impossible. According to 2017 data, 95% of home buyers searched for a home online and 43% applied for mortgages online, but effectively no one closed online.

This changed in 2018, and the ability to close online won’t just be expected: it will be demanded.

- 95% of people search for a home online

- 43% now apply for a mortgage online

- ~0% close digitally

We’re only a year or two away from an instant mortgage and closing.

How?

Blend Labs, Roostify, and others have made it possible to apply for a mortgage online. Fannie Mae, Freddie Mac, and others now perform automated underwriting during the application process with a purchase guarantee - for the mortgage, not the property. Blend and others tie into these systems, so someone can apply for a mortgage online and the lender can instantly check that it will be accepted when sold into the secondary market.

Notarize then eliminates as many as 45 days from the closing process by integrating directly with the lender and title company’s systems. We pull documents instantly and empower the borrower to click to close at their convenience, 24x7.

What people don’t appreciate is that this changes everything about how the mortgage is funded and then sold. As soon as the borrower clicks complete on Notarize, the documents are delivered into the secondary market within milliseconds. This dramatically changes the cost of capital a lender pays to fund their customer’s mortgage.

Right now, Notarize enables the instant real estate transaction and instant mortgage. And our partners are starting to adapt their policies and business practices to our technology.

Why Real Estate Companies Dominate Today

Alex suggests that real estate companies can charge high fees because of regulation. That’s overly simplistic. They charge high fees because they’re central to the entire transaction today.

The truth is that the best realtors make their living off seller leads. These are won on reputation. Top performing realtors help people sell homes sooner and at higher prices, so they are referred more homes to sell.

These leads put them in a position of power. They can dole out early access to great properties to other brokers in their own firm first, or trade that knowledge for future access. What top performing realtor would ever leave that model and switch to a full-time position at a digital player for less money?

What’s more, a buyer working with a digital provider may have actually been at a disadvantage for the past decade.

Imagine two people wanting a house and presenting an offer to the seller and her agent, Tim. One prospective buyer comes from the internet with a broker no one knows. The other comes with Nancy, the local realtor who has negotiated across from Tim numerous times.

Nancy tells Tim they’re working with Bob, the local mortgage lender, and the buyer is good for the money. She’s already called Mark, the home appraiser, who is booked three months out but is willing to do a favor.

Which offer do you think the seller will take?

In the digital world, the buyer is alone and has to do it all independently. That’s a worse experience, not a better one. So in that environment, how does a digital player compete?

By building an end-to-end mortgage experience that’s better than the analog equivalent. The strengths of digital are choice, speed, and convenience. The race is to be the first to marry these.

Whoever Owns the Buyer Experience Wins

Everyone is verticalizing, not just the startups Alex noted.

Redfin launched a mortgage lender and title company. Zillow just purchased a mortgage lender. These companies have the buyer leads the financial players want so desperately.

Everyone assumes their aim is simply increasing revenue captured per user, but the larger goal is actually to connect the dots with systems they control to deliver that seamless end-to-end experience. Most nonbank lenders are already here as well. Quicken owns Amrock. Loan Depot owns Closing USA. Guaranteed Rate owns Ravenswood.

Making things even more interesting, Quicken just moved up the stack and bought forsalebyowner.com.

Why is this happening?

The end-to-end experience will unleash extraordinary cost savings for the providers and for buyers and sellers.

The average cost to originate a mortgage has gone up 400% in 10 years, to $8,900. Today, Fannie Mae estimates that the digital execution of a mortgage will save an originator $1,100. There are similar costs for title companies that average more than $5,000 in processing costs.

We think there’s potential for even greater savings.

Any cost savings can go right back into customer acquisition to gain share. And data shows 74% of customers will actually switch brands for improved customer experience, which they’ll finally have by going digital all the way.

What’s to Come of the Companies Buying and Selling Homes?

The capital markets have seen algorithmic traders dominate by volume. If true liquidity is created in the real estate market, there’s no reason to assume the same won’t occur with companies like Opendoor buying and selling homes as the market oscillates.

What’s Next?

You will see Notarize’s existing mortgage lenders offer something akin to an “Instant Mortgage” within the next two years, meaning application through closing will happen within 48 hours. More companies than you can imagine will adopt these capabilities. Notarize’s platform will do all the work; they simply need to onboard.

Our vision is that someone should be able to walk into a home, fall in love, and buy the home online, same day. We are well on our way to doing just that.

Tweet Vote on HN -

What Notarize has taught me about startups and venture investing

Notarize started as a fun project. I thought, “someone is going to build the notary app, might as well be me.” Since that fateful decision, this company has asked more of me [ + my family and the team] than I could have ever imagined.

Today marks a major milestone for Notarize as the National Association of Secretaries of State updated their standards to allow for online notarization. This represents more than to 2 years of regulatory and advocacy effort and is an extremely important milestone for Notarize and industry at large.

What started out as a fun project where I could learn more about WebRTC and mobile app development has become a full scale political campaign, lobbying effort, brain spar over some of the most antiquated law in the country, the invention of new operating models for real estate transactions, the resolution of nearly fifteen years of unsolved technology and legal issues, the creation of an entirely new product category, coalition building, the successful advocacy for and passage of new state laws, and a hard fought battle to get some of the oldest industries to fundamentally change their way of life to adopt new technologies… and ultimately partner with us to bring our product to market.

Momentum is only growing. Today, we also announced support for purchase transactions in sixteen states in partnership with a top ten lender, United Wholesale Mortgage and Westcor Title. After helping to pass legislation in Texas and Nevada last year, we expect several additional states to pass online notarization bills over the coming weeks.

I read the quote once, “most startups die because no one gives a shit.” It stuck with me. I reference it often. Well, Notarize has never lacked for relevance or impact. Two months after we launched, the National Association of Secretaries of State launched their task force to study online notarizations and the title industry woke to our impact. When we launched our business product, some of the largest lenders, auto insurers, and private wealth firms came inbound. We’ve traveled to nearly 40 states, presented or met with almost as many Secretaries of State, have met the C suite of virtually every major bank or lender, and have jumped through so many hoops to meet so many people I can’t even begin to list it out. Even the National Association of Realtors made a strategic investment in our company. In short, more people give a shit about Notarize than I could have ever anticipated. Many love us. Some hate us. It’s insane.

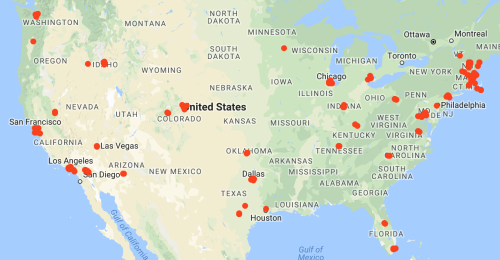

The last 18 months of my life in one image:

I track my location with Google Timeline [and have since 2010 across various services]. That map is actually missing a few places when it shut off. And, I’ve been to most of those places more than once and several more than 10 times in just 18 months. Adam’s map is just as bad if not worse. Same goes for Michael Chodos, our general counsel, and Jennifer Parker, who heads our digital mortgage team. If you include the rest of the team on that map, nearly every state is marked.

The sun never sets on a day without a Notarize team member getting on a plane.

Turns out, changing how you notarize a document actually changes everything about some of the largest and oldest industries in the country. And, in our business, you can’t force anyone to do anything. Our partners and regulators need to be convinced. They need to be onboard.

There was absolutely no way of knowing we’d have this impact. Frankly, if I knew what it would take, I don’t know if I would have ever started this company.

What are the lessons?

- As an entrepreneur, there is absolutely no way of knowing where your idea will take you or what it will require. If your goal is to build something meaningful, you better be ready for whatever it takes.

- Don’t go it alone. Making change has deep deep lows. Given the swings, you need at least one other person so you can take turns rallying each other to the cause. Better yet if you actually like the other person [Hi, Adam]. And that’s ignoring everything about the emotional support a spouse provides - Jill’s help deserves a post of its own.

- The juice better be worth the squeeze.

- As an investor, the job is to assess where an idea might go and if the founding team can go anywhere and do anything to make it happen. A company’s current state is only input in that evaluation.

- Companies like Notarize require a team of believers. It’s not a job, it’s a mission. Everyone will be asked to step to the plate.

- If you want to effect change, the single most important things you can do are to know the issues better than anyone and always show up. [see map above]

- Venture capitalists have no interest in effecting change, they just want to make money. [More on this in the future]

- If you are trying to effect change, the single greatest challenge is actually to survive long enough to reap the benefits of what you’ve accomplished.

I’ll end with one of my favorite quotes.

“I know what hard work’s about. I still come back to what my strategy always was and will continue to be: I’m not the smartest guy, but I can outwork you. It’s the one thing that I can control.” - Mike Bloomberg.

Good plan, Mike.

PS: Thinking of our General Counsel, Michael Chodos, as I write this. He’s between three or four States just this week.

Tweet Vote on HN -

Notarize for Mortgage

I’ll never be able to share just how hard it was to pull this off, but Notarize is the first company and platform to allow people to buy their home entirely online.

Read more about it on the Notarize Blog or check out the new marketing site - Notarize for Mortgage.

Tweet Vote on HN